Understanding Affirm to Finance Your TrueFacet Purchase

TrueFacet partnered with Affirm to help you finance your purchase.

Affirm makes it easy for you to buy now and pay later with monthly payments for your TrueFacet purchase. With Affirm, there are no hidden fees so you know exactly what you’ll owe before you commit. There are no hidden costs and no surprises.

To help you learn more about Affirm’s services, here are some of the most frequently asked questions and a step-by-step guide of how to checkout on TrueFacet.com using Affirm.

What is Affirm?

Affirm is an honest and modern financing solution that allows you to pay over time, on your terms. When you buy with Affirm, you can pay off your purchase in fixed monthly payments with no hidden fees, modern security, and superior customer support.

What information does Affirm require?

Your Affirm account is created using your name, email, mobile phone number, birthday and last 4 digits of SSN. This combination helps Affirm verify and protect your entity.

How is financing through Affirm different from putting it on my credit card?

Affirm is a very different product than a credit card. Affirm is a closed end installment loan while a credit card is a line of credit. Affirm also does not charge any sort of origination fees, late fees, or pre-pay fees. Affirm’s credit check doesn’t affect a consumer’s credit score, as opposed to a hard credit pull that many credit cards require. Checking out with Affirm requires 6 pieces of information in, as opposed to typically longer full credit card application, and Affirm automatically has payment reminders enabled and also has auto-pay options.

Does Affirm perform a credit check?

Yes, when you first create an Affirm account, Affirm performs a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score.

What are my payment options?

When you make a purchase of $100 or more with Affirm, you can pay over 6, 12, or 24 months.

Are there any interest fees associated with Affirm loans?

Affirm loans vary between 0% and 30% APR, subject to credit check and approval. Affirm does not charge late fees, service fees, prepayment fees or any other hidden fees.

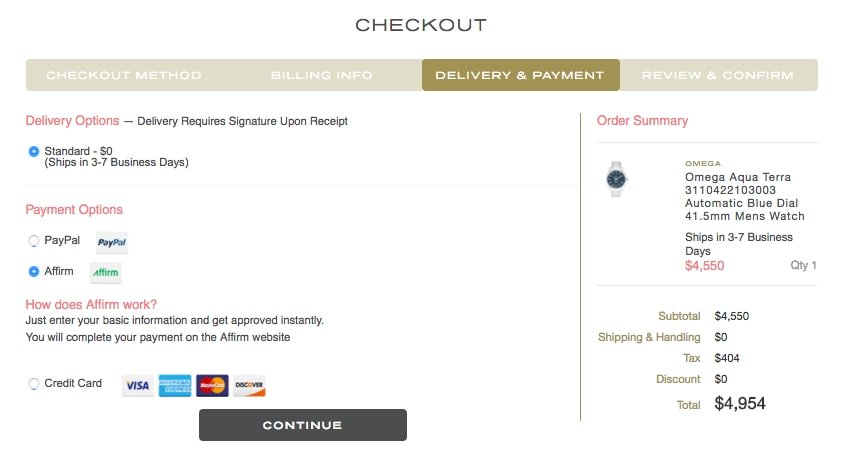

How do I checkout on TrueFacet using Affirm?

To apply for an Affirm loan, simply enter in some basic information and get a real-time decision to split your purchase into three, six or twelve monthly payments with rates from 0-30%APR*. You can also find out your terms without affecting your credit score.

When you’re ready to checkout with Affirm, go to your shopping cart on TrueFacet.com. Complete your shipping and billing address information as usual. Then, under your Payment Options, select Affirm. Click Continue.

On the Review & Confirm page, verify your information is accurate and click Place Order. From there, you’ll be redirected to Affirm’s website and prompted to securely enter in your information for financing approval. You will complete your checkout through Affirm’s website but will receive a confirmation email from TrueFacet once your order is finalized and received.

What will my monthly payments be?

Enter in some basic information about your purchase into this Affirm calculator for an estimate of what your monthly payments will be.

For more information about Affirm, visit their website affirm.com or email help@affirm.com.

*Rates from 10–30% APR.Subject to credit check and approval. Down payment may be required. For purchases under $100, limited payment options are available. Estimated payment amount excludes taxes and shipping fees. Affirm loans are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC. See www.affirm.com/faqs for details.